Autumn Budget 2024: Key Impacts on the UK Real Estate Market

Diana Karagkasidou

Diana Karagkasidou - •

- 16 Dec 2024

Autumn Budget 2024: Key Impacts on the UK Real Estate Market

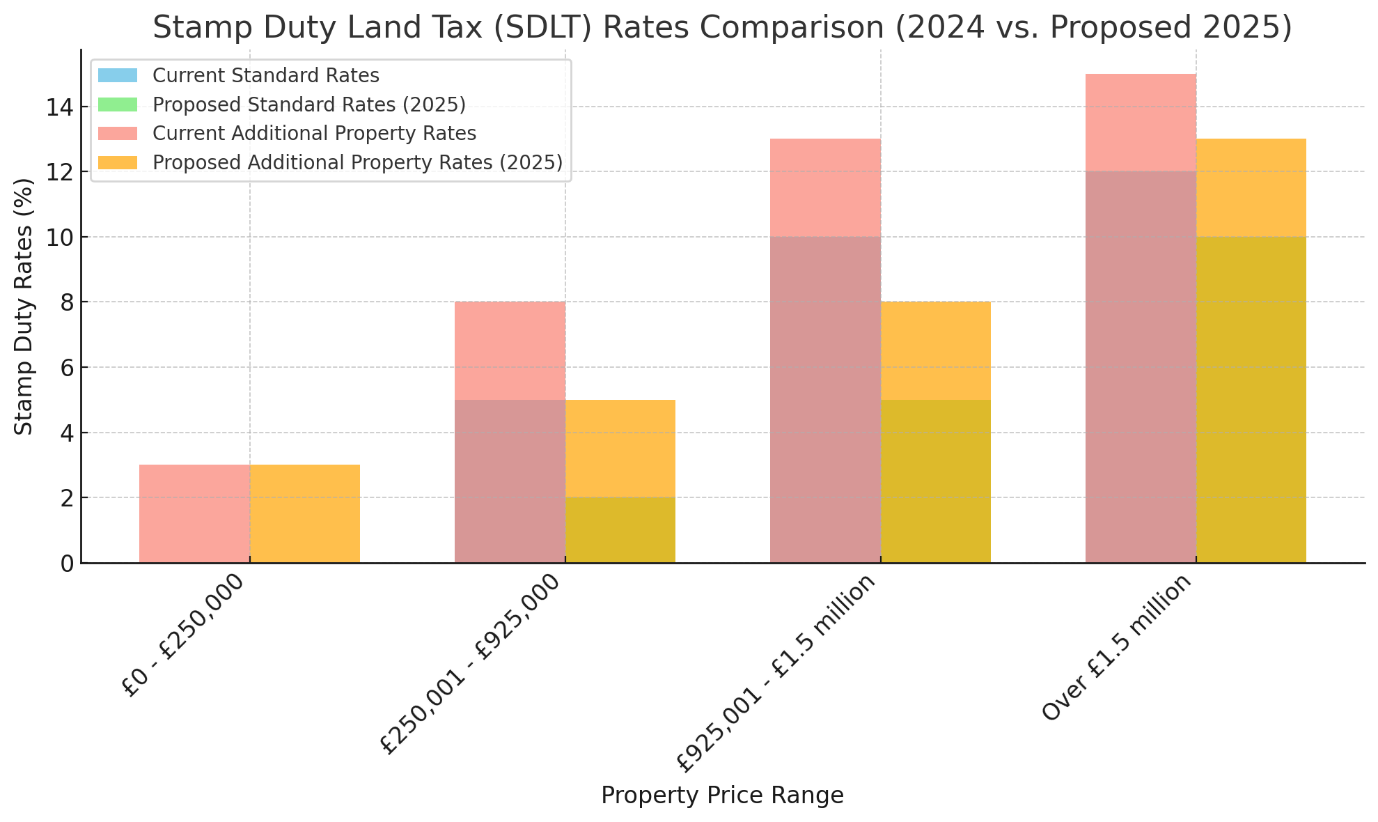

The UK property market is going through some big changes after the Autumn Budget 2024, especially with updates to the Stamp Duty Land Tax (SDLT). These changes will impact how much buyers pay and how they plan their purchases. While it might feel like a challenge at first, it’s also an exciting time—especially for anyone interested in new-build homes. Developers are stepping up with some fantastic incentives to help buyers save and make the most of these opportunities.

One of the biggest adjustments is that, from April 2025, the amount at which SDLT kicks in will be cut in half—from £250,000 to £125,000. This means more buyers will need to pay stamp duty, which could make purchasing a home a bit more expensive. First-time buyers, who currently get relief on properties costing up to £425,000, will see that limit reduced to £300,000. For those buying an additional property, such as a buy-to-let or holiday home, the 2% surcharge will remain, making those purchases more costly too.

Here’s a practical example to break it down. If you buy a home in Central London for £1,250,000 as your main residence:

With these updates coming, developers are stepping up to make buying new-build homes more appealing. Many are offering to cover the cost of SDLT for buyers, which could save you thousands of pounds. Some are also including extra perks like upgraded kitchens, luxury fixtures, or even help with your mortgage payments. These incentives can make a big difference, especially as the new SDLT rules come into play.

“As @Druce New Homes experts, we specialize in helping you negotiate deals where developers cover the SDLT costs as part of the agreement. This allows you to focus on finding your dream home without the added stress of extra expenses,” – Zenonas Georgiou, New Homes Sales Manager at Druce.

If you’re buying property from outside the UK, things are a bit different. Since April 2021, non-UK residents have had to pay an extra 2% on top of the regular SDLT rates. If you’re buying a second home, you’ll also need to pay the surcharge for additional properties, which can make the purchase pricier.

To qualify for the regular UK rates, you (or your spouse) need to have spent at least 183 days in the UK in the 12 months before buying the property. If this doesn’t apply to you, you might want to explore other ways to reduce costs, like taking advantage of developer incentives on new-build properties.

If you’re planning to buy a home, it’s a good idea to act quickly. The average property transaction in the UK takes about five months to complete, so buyers hoping to finalize before the April 2025 SDLT changes need to start soon. In areas like Marylebone, St John’s Wood, and Maida Vale, where properties often cost over £1 million, SDLT can add up fast. Detached homes in Regent’s Park, for example, have an average price of over £6 million, meaning buyers here will likely pay the highest SDLT rates.

Yes, the new SDLT rules mean some buyers will pay more. But this also creates opportunities, especially for those looking at new-build homes. Developers are keen to sell, and they’re offering deals that make buying now more attractive than ever. In East London, developers offer amazing 2-bed options at an average price of £720,000, with rental yields reaching 6%, making it a promising investment opportunity. Now is the time to take advantage of these favourable market conditions before the changes come into effect.

If you’re thinking about buying a property, whether as a first-time buyer, an investor, or for your next family home, this is a great time to explore your options. For more detailed insights and the latest in property, visit our @Druce Latest News & Blogs page.